loading...

loading...

WHAT WE DO

We will assist you with payroll or you can do it yourself and engage us to do the reporting. We can also be more involved as you wish: electronic payments to employees, an electronic deposit of payroll taxes from business accounts, and quarterly/annual filings of payroll tax reports. Owners find it very convenient for us to be involved in this process because we can calculate and pay their tax obligations timely as the year unfolds. We provide back office services so you can focus on running your business. The primary goal here is to avoid the very substantial penalties that can result from faulty payroll tax fillings.

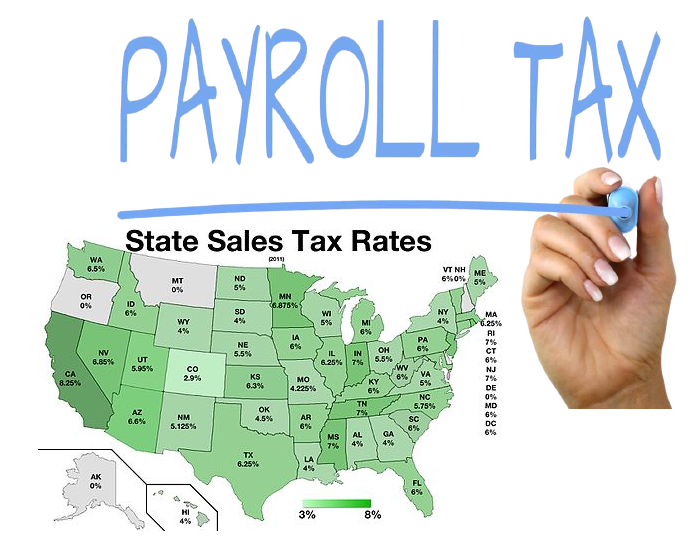

We can calculate multi-state sales tax amounts and file the monthly, quarterly, and annual sales tax returns on your behalf.